Support

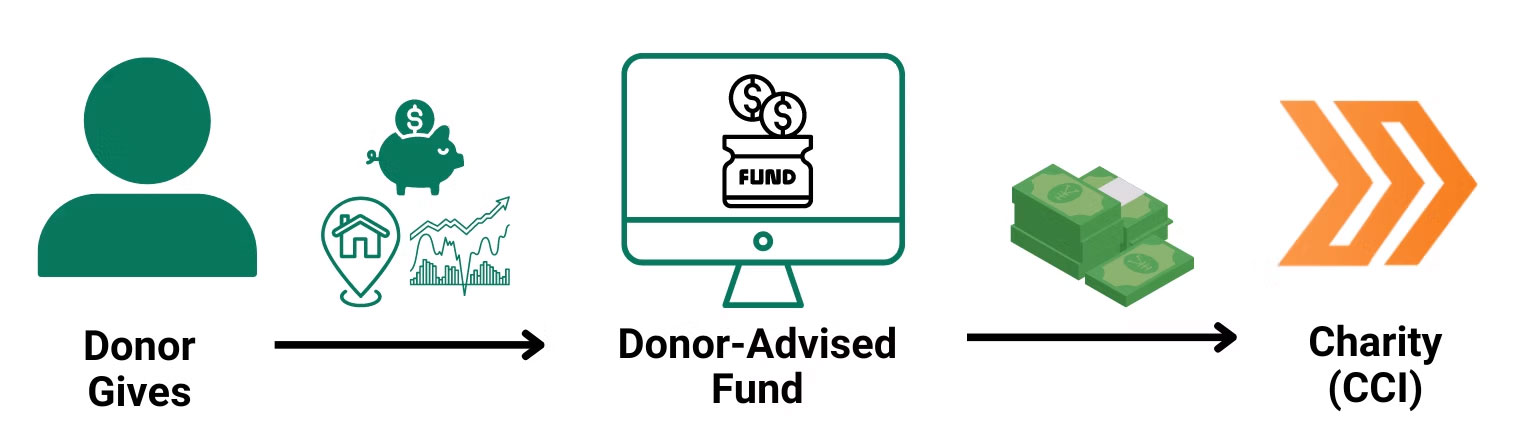

Donor-Advised Fund (DAF) and Noncash Giving

What is a donor-advised fund?

A donor-advised fund or giving fund works like a charitable checking account. You can contribute assets such as cash, stocks, business interests, real estate, and other noncash assets. And when you are ready to give, you go online and recommend grants to a charity.

What are the benefits of a DAF?

- Ensures grants meet IRS standards

- You spend less in taxes, so more money goes to charity

- Personal savings - full tax deduction means savings on tax returns

- Investment options to help your fund grow

- Manages all your giving online and from one fund

- Reduces paperwork and receipts

The donor donates cash, stock, and other noncash gifts to a Donor-Advised Fund. The donor receives an income tax deduction and avoids capital gains tax. From the DAF, the donor then recommends grants to the causes and charities he/she cares about.

For more information call or email Glenn Kurka from Crossing Cultures International (CCI) to facilitate your gift. Call 434-509-3988 or email gkurka@cciequip.org